Our activities

Our range of financing and services

Retail Banking

CCF Bank

Created in 1917, the CCF opens a new chapter in its history on 1 January 2024.

A French bank with a human scale and a wealth of assets

CCF is a French bank with a human-scale approach to wealth management, offering tailor-made support to private individuals and professionals. CCF offers excellent relationships and expertise, as well as fluidity and simplicity.

CCF is headquartered at 103 rue de Grenelle in Paris and has a network of branches throughout France.

CCF Experience

Excellence in relationships

You are supported by teams who know you, both on a day-to-day basis and at every important stage in your life, for you and your family.

Expertise

To advise you and amplify the impact of your choices, we provide you with teams of experts in wealth management, taxation and investments.

Fluidity and simplicity

You choose the method of relationship that suits you best, in-branch or remotely, via your app or over the phone, always accompanied by your dedicated adviser.

Specialised Financing

Debt consolidation

Debt Consolidation

As a major player in the credit consolidation market, My Money Bank offers, either directly or through its distributor partners, IOBs (Intermédiaires en Opération de Banque), a complete range of mortgage and consumer credit consolidation products, with or without a mortgage guarantee.

of credit consolidation offers, for both property and consumer loans, with or without a mortgage guarantee, and personalised credit consolidation offers (for senior citizens, the self-employed, life events, financing new projects) for private individuals.

Credit consolidation solutions are available in mainland France and the French overseas departments and territories.

Equipment and car financing

CCF Group is a major operator in point-of-sale car financing, with its overseas subsidiaries Sorefi in La Réunion and Somafi-Soguafi in Martinique, Guadeloupe and French Guiana. Through its distributor partners, Group CCF offers :

For retail customers

Our solutions for private customers:

Sale on credit (SOC).

Leasing with an option to purchase (LOA).

For corporate customers

With a range of products enabling decision-makers to make the investments they need to grow their business: industrial and agricultural equipment, office and IT equipment, transport, handling, construction and public works, vehicle fleets (sale on credit, rental products and tax exemption).

Our optional insurance

As an insurance broker, we offer insurance and additional optional services, together with our loan and lease financings to retail and corporate customers:

- Guaranteed auto protection (protection for vehicule total loss);

- Warranty extension to protect customers from the cost of repairs in case of mechanic breakdown and provide road side assistance towing replacement vehicule;

- Borrower insurance.

- View our automotive financing offers in French Overseas Territories:

Professional Mortgage

My Money Bank is an expert bank in the market for financing property professionals.

The activities of the real estate division

My Money Bank is a recognised player in the financing of real estate transactions and property development. A genuine partner from the outset of the project, its teams have developed a major position in this business thanks to their unique expertise, invaluable advisory skills and the establishment of relationships based on trust.

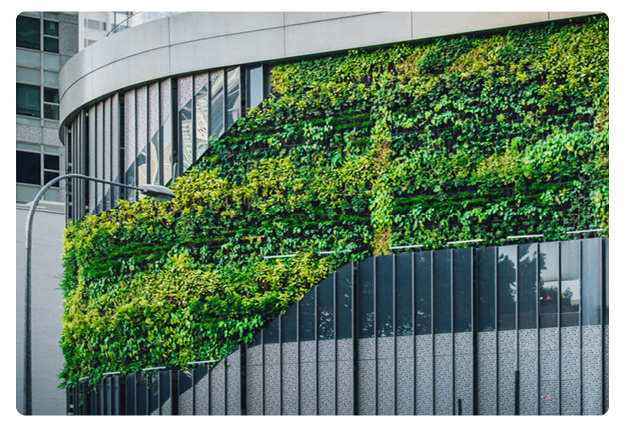

Green Finance

My Money Group is determined to help limit global warming. This commitment takes the form of helping its customers to make the transition to an energy transition.

The Group has therefore decided to integrate environmental, social and governance (ESG) criteria into the heart of its development and financing offers.

Since 2021, a green financing offer has been available to its professional customers through our Professional Property division.

Our objectives

- To support its customers in the necessary energy transition of their property portfolio in order to comply with regulatory requirements and reduce the energy consumption of buildings,

- To have a strong, committed approach as a bank,

- To play our part in reducing our carbon footprint.